时间:2024-03-22|浏览:262

K line

Also known as candlesticks or candlesticks, it is a charting tool used to represent price movements in financial markets. It originated in Japan and was initially used to record price fluctuations in the rice market. Later, it was widely used in technical analysis of financial markets such as stocks, futures, and foreign exchange. The K line consists of four main parts: the opening price, the closing price, the highest price and the lowest price, which together form a rectangular entity and two upper and lower shadow lines.

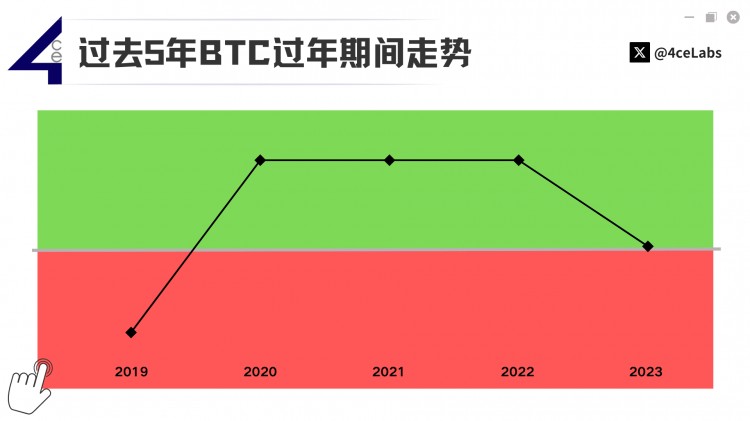

There are various forms of K lines, and each form has its own specific meaning and predictive significance. For example, a positive line indicates that the closing price is higher than the opening price, which is usually regarded as a signal that the market is rising; while a negative line indicates that the closing price is lower than the opening price, which is usually regarded as a signal that the market is falling. In addition, there are special forms such as cross stars, hammers, hanging lines, etc. Each form has its own unique analysis methods and application scenarios.

K-line analysis not only focuses on the shape of a single K-line, but also focuses on the trends and shapes formed by the combination of multiple K-lines. For example, when a series of positive lines appear continuously, this is usually regarded as confirmation of the market's upward trend; while when a series of negative lines appear continuously, it may mean that the market is about to reverse. In addition, K-line analysis also focuses on the relationship between price and trading volume, as well as price performance in different time periods.

When conducting K-line analysis, investors need to pay attention to the following points. First of all, K-line analysis is not omnipotent. It is only an auxiliary tool and cannot completely predict market trends. Secondly, K-line analysis needs to be combined with other technical indicators and market information to make comprehensive judgments. Finally, investors need to remain calm and rational and not be fooled by short-term market fluctuations. Instead, they should pay attention to long-term market trends and fundamental factors.

In short, K-line knowledge is an important part of technical analysis of financial markets. By learning and mastering K-line knowledge, investors can better understand market trends, formulate more reasonable investment strategies, and achieve better investment returns.

$BOME $DOGE $BAKE