时间:2024-01-01|浏览:366

Regardless of whether you think 2024 is the bull top or 2025, whether you think Bitcoin will exceed $100,000 or $300,000, whether the currency circle is going up all the way or there is a deep correction, there is an opportunity to get on the train at a low price again, consensus The whole point is that after the Spring Festival of 2023, it’s time to prepare for the big cows.

In addition to Bit Ether, more people still want to seize what may be the last opportunity for excessive returns on cryptocurrency and completely turn their lives around. Then they must find a target that is ten times, or even a hundred times the target.

There must be such a target. In the bear market, there are a lot of 100-fold coins, and even 10,000-fold coins like pepe and ordi. It is nothing more than whether you can hold it at a low price and whether you can hold it until you sell it at a high price. Do you want to adopt this investment method that is more difficult than simply investing in leading companies such as BitEther? Is it meaningful to conduct research? Because when the big bulls come, everything will go up? How do you find such a target? Are there any standards? When you find such a target, should you buy it at the bottom or make a fixed investment at one time, or invest in it before rotating into different sectors?

This article will answer these questions. It will not directly show the wealth code. I will show some in the future, but not too much. After all, this will be the result of hard research within my industry research team and will be shared with VIPs. .

So if you don’t plan to join, the logic of this article is worth your collection and viewing.

First, which method to choose? Is it simple investment or research investment?

10 times 100 times coins, both rain and dew will happen in Daniel, and there will be opportunities in all tracks. Therefore, a safer way is to invest in separate positions. Each track will ambush in advance, and most people usually ambush Long One, Long Two. This is not a big problem from the perspective of sound investment. On the one hand, it has achieved high returns in the encryption circle, and on the other hand, it has balanced the risk of the project going to zero or being a black swan.

The best convenience is that you don’t need to do in-depth research, just follow the market and buy. Open Binance, buy the top two in market value in each track, and then wait for one to one and a half years, and you will be rewarded.

Moreover, as everyone has heard from many financial theories, instead of buying high-yield stocks or currencies thinking you are smart, it is better to directly choose the targets that the market has screened for you. Being able to enter Dragon One and Dragon Two means that you have already There is market consensus, and in the long run, only these coins can go through the bull and bear markets, and those coins that are popular for a while may have disappeared.

The above logic is reasonable to some extent, but for those who have limited capital and are eager to make a complete turnaround in a bull market, as well as those who are forced to change their lifestyle due to personal life pressure or geopolitical crisis, the previous method is obviously not enough. use.

In addition, the above logical construction is based on a premise that we pay attention to certainty and believe that only through the market consensus can we have investment certainty, especially if we need to cross the bull and bear market, only a few leaders in the track can do it, and most of them can achieve it. Projects either go to zero.

Or it will be difficult to return to the glory of the previous bull market.

But why do we need to cross the bull and bear market? Can't we just seize the day and make quick money in the bull market trend of half a year to a year and a half? Let’s look back at the start of the last bull market. Which currency in any track can be ranked in the top 10 or even the top 15 in each track, but has it returned to zero or has not risen much in the bull market? I searched around and found it wasn't there.

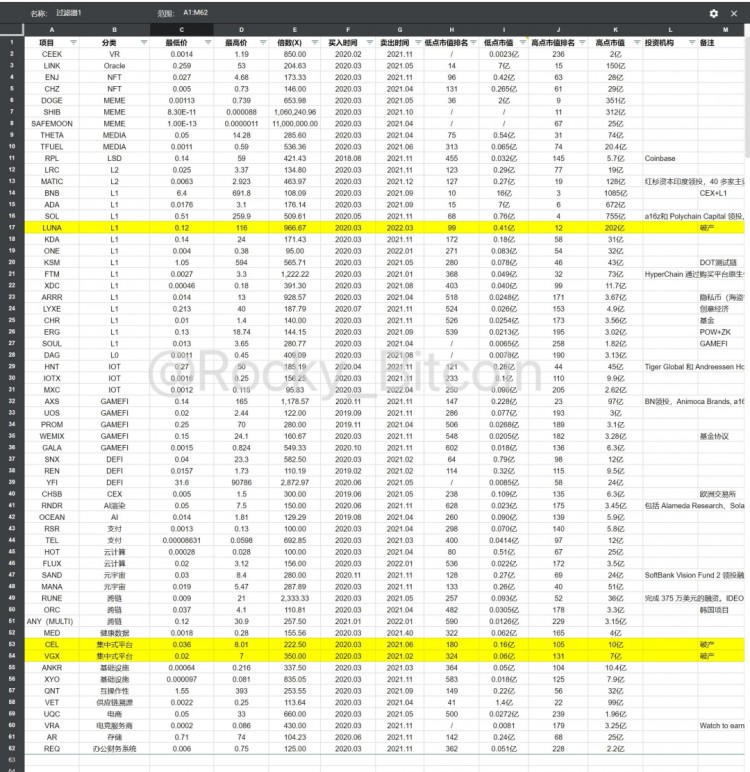

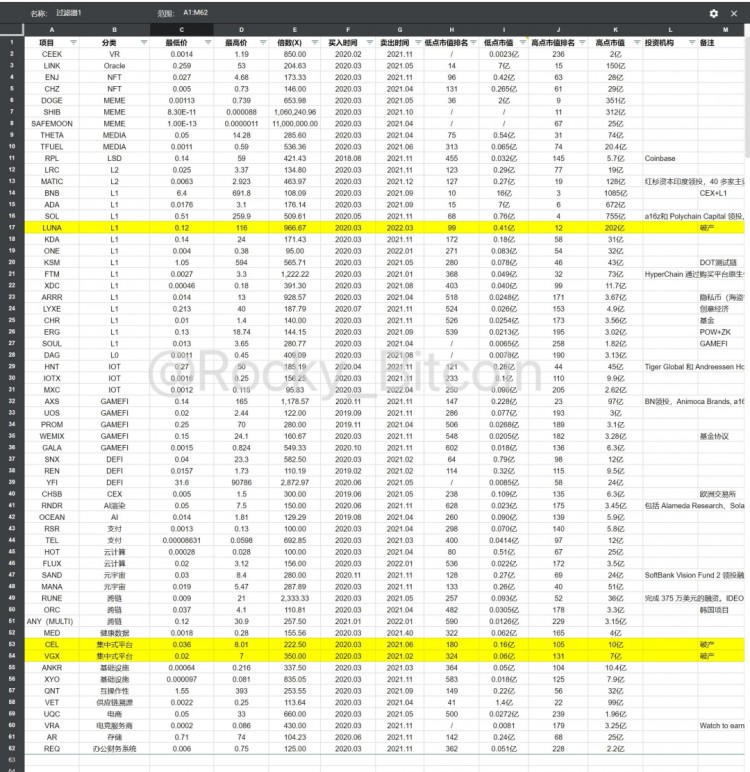

And when we open the 100-fold coins in the last bull market, we can see that most of them are not Long One and Long Two in this track.

What’s even more interesting is that I accidentally came across a guidance article written at the end of 2019. The author believes that the copycat giants in 2017 have passed, and it is unlikely that the big bulls in 2020 will have too many opportunities to copy the giants. The article seems very rational and calm, but the conclusions it reaches are proved to be absurd by the facts.

Two days ago, I was watching some bloggers with tens of thousands of fans. Their expressions about Inscription Track were still calm observations, and their fundamental value was not great.

Perhaps, the small circuit of the crypto circle completely copies the theory of traditional financial formation, but there are still many places where it is not applicable.

Being calm is worthless in the bull market. Looking for dragons, one and two can only change your life. Traveling through bulls and bears is not the goal pursued by losers like us. Whether virtue can carry enough wealth is a question that is better to wait until I have enough wealth. Ask me about your wealth.

This is my advice to the little leeks at this stage, and my current stage is to maintain both integrity and innovation. On the one hand, I have experienced the ups and downs of wealth, and obviously I can no longer go to the stud cottage, but on the other hand, if I want to have an excess In terms of income, I must also allocate a sufficient amount of copycats, but these copycats cannot be randomly selected. I have to organize people to spend energy and in-depth research.

The next question is, is doing research useful?

I once had a friend who was a big boss in the mining industry. He was young, worth tens of millions, stable and calm, and had built-in anti-noise function. In his eyes, noisy conference exchanges were meaningless, and in-depth research was even more useless.

For lazy people or people who are already big money players, just use diversified investments in Long One and Long Two. Research is of no value to them. Just use horse racing to select targets.

For those who want asset returns to exceed ten times or even dozens of times, Xingyan is extremely useful.

Without industry research, even if you diversify your investment into the top 200 companies in terms of market capitalization, the probability of Mongolia being more than 10 times higher will not exceed 10%;

Without industry research, even if you win more than 10 times the bid, it will be difficult for you to get a higher position because you do not understand its intrinsic value;

Without industry research, even if the result is more than 10 times the target, the funds are not fully utilized, because the best way to invest funds is to predict the rotation of the sector and the favorable timing of the target in advance, so as to make the first move with the rotation of the sector. .

Although practical research cannot solve 100% of the above problems, based on my past experience, it is feasible to achieve an accuracy of 70%.

So, where will the ten-fold coin target come from? What will be the standard for 100x coins?

First of all, there is no absolute distinction between the two, but there is a high probability of division.

Tenfold coins are generally old coins that have performed well or coins born in the bear market. Due to the continuous operation of the project side, in this bull market, not only can it recover the decline of the bear market, but also due to the comprehensive upgrade of operating levels, coupled with some minimal innovations New, even surpassing the last bull market.

Hundred times coins are generally coins that are born at the end of a bear market or at the beginning of a bull market. Yes, they are the latest new targets. Due to the lower valuation and the emergence of greater innovations in the track, technology, or marketing model, Then based on the existing valuation and price, a hundredfold gain was achieved.

As for the specific standards, we will talk about them in the next issue. Here we only give a general logical direction.

Whether it is a ten-fold coin or a hundred-fold coin, it is difficult to have the shadow of old currencies such as BTC, ETH, and XRP. On the one hand, the decline in the bear market is not as much as 90%, so it is difficult to have a 10-fold increase. The volume is large, and even if there are disruptive innovations, such as Ethereum sharding and expansion, the explosive power is still not as good as new currencies or new tracks.

Of course, what we are looking for is not that it has to be exactly 10 times, or 100 times. There is no clear distinction between the two, but that there are generally two extremes for choosing different investment targets, and many targets are between the two extremes.

Another question, does grasping 100x coins have something to do with the track? Is there any priority?

As discussed before, within the bull market cycle, it is difficult for the seed players of 100x coins to return to zero. Therefore, the security and stability are not much different from Long One and Long Two, so we only look at it from the perspective of yield. Arrange next order.

The first is the innovation track, new currencies that are very popular, or currencies that have not yet been issued, such as L2’s STARKNET.

The second is the innovation track, the latest currencies that have been verified to be feasible, or currencies that have not yet been issued, such as SOLS on the SOL chain.

Once again, it is the innovation track. It is a coin issued in a bear market that has been verified to be feasible, and the FDV is less than 100 million US dollars. Of course, a lower point is better, but it cannot be too low. Too low means that the fundamentals have not been recognized in all aspects. , and another angle is to compare with the current leader of the track, the market value is within 20% of the leader, such as TURT of the Inscription Track.

Next is the non-innovative track, but the project itself has innovative new projects that may not have issued coins yet, such as COW in the DEX field.

Then there is the non-innovative track. The bear market has suffered a large decline and there are innovative old projects, such as GALA in the Gamefi field and sol in the public chain.

Finally, there is the non-innovation track. There is a large decline in the bear market, and there is no innovation, or innovation that is just a slogan, but the project side has been operating projects, such as FIL in the storage field.

As for other tracks, everything is stable, so it’s hard to have expectations.

The last question is, does the investment target have a time priority?

The previous one addressed the priority of investment level or positions, but now we are talking about the priority of time.

Of course, if the layout is dispersed at the beginning of the bull market, each target can get chips at a lower price accordingly. Although there is sector rotation, sector A is soaring, and sector B will most likely not stay still. It's just a matter of how much it rises or how little it rises.

But if each sector has a basic position, and the position is tilted appropriately based on the predicted sector rotation, it will undoubtedly be able to maximize the use of funds. You must have felt the recent Mavericks, first bits, and then It was Inscription, then TRB and other oracles, then the sol ecology, and the new public chains, sei, tia, and then came the big time of the game and other explosive developments, and recently returned to the inscription track. If positions are adjusted appropriately, the total return will be higher.

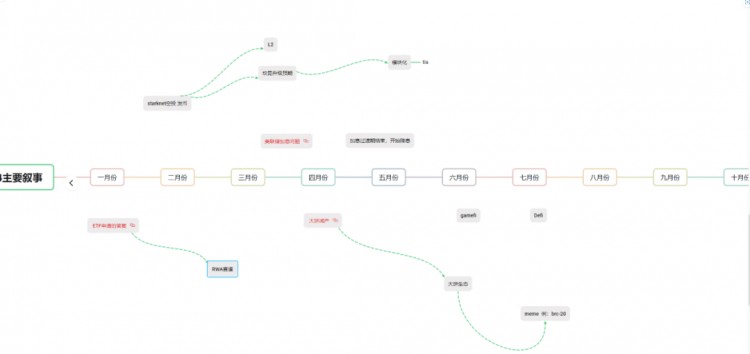

So next year’s sector rotation, is there a vague correctness now? There are some, please look at this picture.

It is expected that if the ETF is passed next year, there will be waves in the RWA track first;

Next, Cancun will be upgraded to cooperate with Starknet’s currency issuance. First, the Ethereum system and the second layer will have explosive pulls, and then other types of public chains will be speculated, such as modular TIA, or public chains in vertical fields;

Following is the production cut in April 2024, I believe Inscription will be great again;

In June 2024, many large-scale gamefi will issue coins. At that time, there should be many game coins similar to bigtime that have skyrocketed dozens of times in a few days. Our team is already making arrangements for this;

In July 2024, based on the continuous optimization of L2 functions and the innovation of DEFI itself, the defi summer will once again begin to explode despite the relative stagflation in the first half of the year.

This article explains that investing in copycats in the bull market is undoubtedly a better choice for Little Leek, and the safety and stability may not be lower than that of leading companies. Since investing in copycats is a choice with greater returns, then industry research is very important, and industry research can answer the question a hundred times What is the standard of the currency? Not only can it find out the hundred-fold currency, but it can also provide a basis for position priority. At the same time, combined with the macro narrative process, it can also make advance arrangements for selecting different positions at different times to obtain higher returns.

The counterfeit 100x coin based on industry research will not only make the income higher, but also allow you to hold the investment more stably. After all, you will know the true intrinsic value of the target, thus supporting you to get the top spot. In the next issue, we will continue to explore the investment basis for finding 100x coins.